How Life360 defined their ICP and went public by doubling down on their safety features and driving up ARPU

Learn 4 key tactics that allowed Life360 to transition from providing information to real-world protection and 5xed their revenue to a 3BN+ company.

For those of you who remember, Life360 launched all the way back in 2010. It was one of the first apps on Android—a utility for parents to check where their kids were in real-time.

This was before Apple had Find My Friends, before Snap Maps took off, and before Zenly built a following. Life360 had the early mover advantage in location sharing, and founder Chris Hulls was one of the first to prioritize app store optimization (ASO). His early ASO strategy helped Life360 dominate app store rankings and outlast a wave of copycat competitors—buying the company time to focus on differentiation.

But a decade in, they faced a problem: install growth alone wasn’t going to drive long-term revenue. People loved knowing where their friends or family were, but that didn’t translate into a strong willingness to pay. Casual users didn’t see the need to upgrade.

What unlocked the next wave of growth was a shift in how they defined their core user. Life360 realized that their most loyal and valuable users weren’t casual friend groups—they were families, specifically parents trying to keep their kids safe. Unlike open social platforms that thrive on large, public social graphs, Life360 was always more intimate—centered around small, trusted family units. That intimacy made it harder to follow traditional social network monetization models like ads or viral growth. But it also opened the door to something more powerful: a membership model grounded in real-world services.

By narrowing their focus to these high-intent users, they were able to design features, messaging, and pricing that aligned with a very specific set of needs—and ultimately build a product that parents trusted enough to pay for.

These changes allowed Life360 to go public on the Australian Stock Exchange (‘360’) in 2019, and then on Nasdaq (‘LIF’) in 2024. You can see the growth in market cap below.

This shift in mindset catalyzed a rethinking of their product and go-to-market strategy. Life360 evolved from a simple location-sharing tool to a safety service, focused on protecting families across driving, home, and online.

Here's what changed:

Their ICP (Ideal Customer Profile) : No longer "anyone who wants to share location" but parents with kids of all ages, especially teenage drivers and toddlers.

Their use case: From "Where is my kid?" to "Reassurance that my child is okay." The emotional trigger shifted from simple curiosity to a deeper need for peace of mind and confidence in their child's safety.

Their monetization model: They introduced a Good/Better/Best membership structure, ranging from $8 to $25 per month. Higher tiers bundled real-world services like emergency dispatch, stolen phone protection, and family safety support.

Their benchmark: They stopped comparing themselves to Zenly or Snap Maps and started positioning their service as a digital replacement for home security systems like ADT or AAA memberships.

Let’s break down how they went after a new ICP—through four tactical plays around pricing, packaging, and personalization that increased ARPU while deepening product-market fit.

Introduction:

Introducing PJ Loury, who led Safety Products at Life360. Before that, he worked on product at Uber and Jawbone. At Life360, PJ played a key role in transforming the app from a location-sharing tool into a full family safety platform.

Tactic #1: How a Good/Better/Best Model Helped Life360 Match Different Family Needs

Problem:

Life360 initially offered two membership options: a freemium plan and a single paid upgrade called Driver Protect. But this setup created an 'all-or-nothing' dynamic—users either had access to only basic features or had to upgrade straight into the full suite of premium protections. There was no middle step. For families who wanted some added peace of mind without committing to the highest plan, this left a gap.

Without a flexible set of protection tiers, Life360 was inadvertently pushing users away by making it feel like the only way to get real safety value was to go all in.

As a result, their average revenue per user remained flat despite growing adoption.

The challenge was how they could increase ARPU while still appealing to a broad audience of families who had differing needs when it comes to protection.

Solution:

Life360 launched a new three-tier membership structure—Silver, Gold, and Platinum—to better match the needs of different types of families. The goal was to create clear, emotionally resonant levels of protection that appealed to different personas.

At the top, they introduced the Platinum Plan ($25/month). This plan was intentionally built for high willingness-to-pay (WTP) users, offering the most comprehensive suite of real-world services. But strategically, it also served as a pricing anchor to make the Gold Plan ($15/month) feel like the smartest, most balanced choice.

The Platinum Plan bundled together high-perceived-value features that delivered peace of mind without requiring heavy engineering investment. Many were offline services supported by partnerships or operational teams:

Identity Theft Protection: Monitors if personal information or passwords have been exposed publicly and offers restoration services if identity theft occurs.

Travelers Hotline: A medical advice line staffed by travel nurses to support families navigating prescriptions, diseases, or care in international destinations.

Disaster Response: 24/7 emergency response through ambulance dispatch for car accidents and police dispatch for personal safety incidents.

Roadside Assistance: A service that connects families with emergency help—like towing, jump-starts, or flat tire support.

The Gold Plan layered on top of Silver by adding mid-cost, high-impact services like crash detection dispatch—features that mattered deeply to the mass market. This tier became the most popular upgrade path because it struck the right balance between price and perceived safety value.

By building for emotional resonance across multiple safety tiers, Life360 created a structure that served everyone—from cautious multi kids households to families with a toddler.

Impact:

+20% increase in ARPU through better tier positioning and packaging.

Key Learnings:

You don’t need everyone to choose your highest-priced plan. It's okay if most users land on the middle tier—as long as it feels like a great deal. The top tier's job is to anchor value and make the mid-tier feel like the smart, balanced choice for peace of mind and affordability.

Don’t go straight to dev resources—leverage marketing or operations to build human-powered workflows that simulate premium features quickly and cost-effectively.

Building a higher-priced, high-WTP tier can help elevate the perceived value of your overall product, even if most users don’t adopt it.

If you’ve gotten this far, you may be ready to check out our Playbook 🔥 now.

Tactic #2: Redesign the Free Package

Problem:

Crash detection, a feature many parents expected to be included by default, was initially locked behind a paywall.

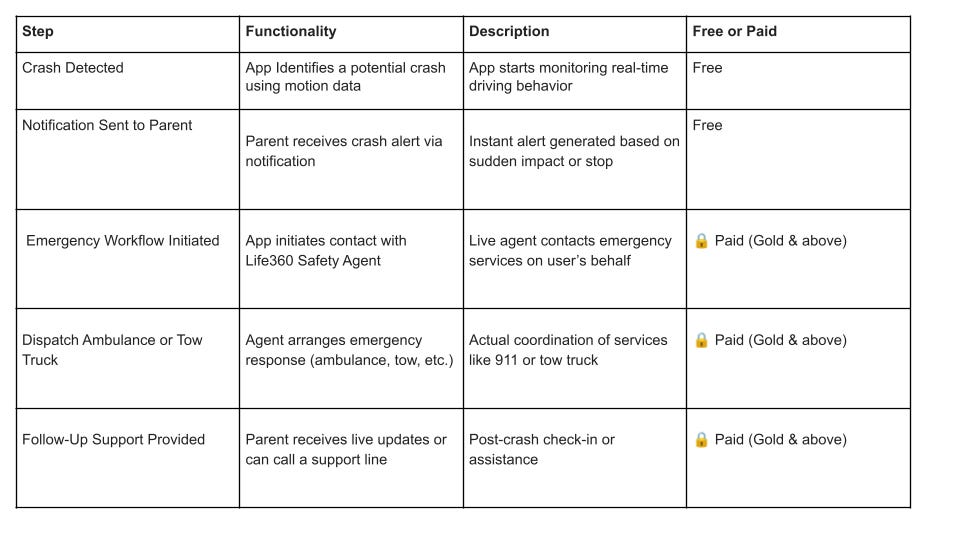

The feature itself was actually made up of two distinct parts:

Detection – monitoring driving behavior in real-time and identifying potential crashes.

Alerting – notifying family members and initiating emergency workflows like contacting roadside assistance or dispatching help.

Parents would install the app expecting a baseline level of safety, only to realize they couldn't access any part of crash-related services without paying. In the data, they noticed many users uninstalled the app on Day 0. When the team dug into churn survey feedback, they uncovered a consistent theme: Parents came to Life360 in a moment of heightened concern, often after hearing about teen driving risks or local accidents. The model required Life360 to nurture more of these users prior to asking them to convert.

Solution:

Life360 made the decision to move the crash detection component into the free tier.

To guide this decision, they leaned on an internal framework that considered:

Cost to Serve – Was the feature expensive to deliver at scale? In this case, the detection layer was software-based with minimal cost to the business.

Perception: Downgrading from safety feels emotionally wrong—no parent wants to tell their child they're "less protected." Very little risk of losing out revenue from an escalated amount of downgrades.

Growth Loop: Offering this high-value feature for free created a powerful onboarding hook for new user acquisition.

The real-world response services like ambulance dispatch and tow trucks that had a high cost to serve remained paywalled, allowing for natural upsells.

Here’s how Life360 split the feature into paid vs. free:

To help convert free users who came in for crash detection, Life360 used a combination of emotional triggers and smart timing. They added contextual nudges like: This drive is not protected. These messages were timed to appear exactly when a parent was checking in on their child mid-drive—a moment of elevated concern and attention. By prompting users with the right message at the right time, Life360 dramatically increased urgency and conversion. The copy emphasized peace of mind and positioned the upgrade as a protective action, aligning perfectly with the emotional reason parents downloaded the app in the first place.

Results:

15% increase in new installs from word of mouth and rave around this new feature

10% increase in monthly upgrades

Key Learnings:

Giving away just the right part of a feature—like crash detection—can drive top-of-funnel growth, especially when it's tied to a clear upgrade path.

Upgrade prompts are most effective when they appear at emotionally charged moments—like checking in during a live drive—when concern is already high and parents are most motivated to act. Timing the message with the user’s real-time intent dramatically improves conversion.

Tactic #3: Change Who You Compare Yourself To

Problem:

Both users and internal teams saw Life360 as a mobile app. The natural comparisons were to Snap Maps or Find My Friends. But those comparisons capped perceived value and made it hard to justify a $15/month or $25/month plan.

Solution:

Life360 realized that continuing to position themselves alongside other location-sharing apps was limiting their growth. Instead, they redefined their category. They weren’t just a mobile app—they were a digital replacement for traditional home safety services like ADT for home security, AAA for roadside help, and insurance products covering phone theft and identity protection.

They leaned into this by introducing "Home Safety Services" into their top-tier plans and rolling out new messaging focused on ROI—showing families how bundling these services through Life360 could save money while offering round-the-clock protection. The membership started to look and feel more like a Costco-style bundle: comprehensive, cost-effective, and built for families, not individuals.

![[Blog] Life360 + ADT [Blog] Life360 + ADT](https://substackcdn.com/image/fetch/$s_!0axL!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe5070990-2550-4dea-b340-ccdf41853ef6_788x457.jpeg)

Impact:

+10% ARPU increase by reframing value and anchoring pricing to higher-ticket services.

Key Learnings:

How users perceive your product directly affects how much they'll pay for it.

Anchor your pricing and positioning to what your customer would otherwise spend on comparable real-world services. Don't limit your comparisons to other apps—your real competition might be a home security contract, a AAA membership, or an insurance premium.

Tactic #4: Go After Your User’s Users and Personalize your Packaging

Problem:

Many of the families coming to their site had multiple kids spanning different age groups, but Life360 had primarily built features for teen drivers. That segment was already retaining and converting well. Meanwhile, parents of younger children—who were just as motivated by safety concerns—had limited tools available to them. The team recognized they were leaving money on the table by not serving the full family unit.

Solution:

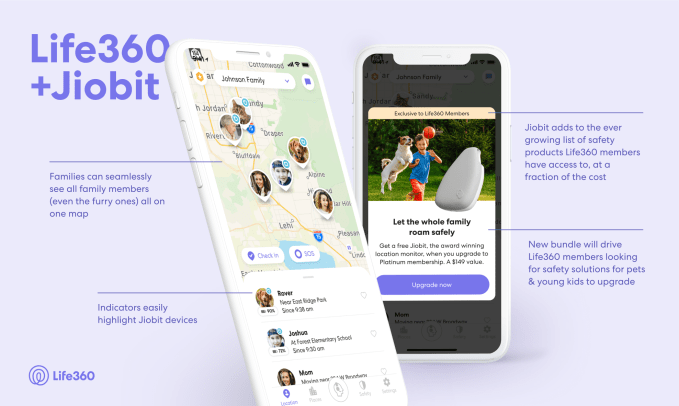

They launched Jiobit, a hardware GPS tracker designed for younger kids without smartphones. Many Life360 families had multiple children, but the product was only built for the older kids. This move allowed Life360 to reach parents earlier—starting the relationship when kids were still in preschool or elementary school.

By bundling Jiobit (hardware) with the Life360 platform (software), they created a new entry point into the ecosystem and added a new revenue stream that didn't rely solely on app subscriptions. It also helped deepen retention by keeping families engaged over a longer life cycle.

This is an example of a vertical pricing strategy—a way to grow revenue within your existing market by creating new SKUs or products that appeal to specific, underserved segments.

Life360 saw that families weren’t monolithic—parents with toddlers had different needs than parents with teens. So rather than trying to force one solution to fit both, they introduced differentiated products tailored to those stages.

Results:

15% increase in ARPU from hardware/software bundling

Extended LTV by 10% engaging families earlier

Key Learnings:

Vertical pricing lets you go deeper in the same market without disrupting your existing base. It allows you to serve different user personas without cannibalizing your core product. For example, Uber initially offered only UberX, but when they launched UberPool, they attracted a new, more price-sensitive audience. Not only did they grow the user base, but they also increased rides per existing user by giving them more situational options—making the service more versatile and habitual.

Your user’s user matters: In Life360’s case, the kids are the ones being tracked, but the parent is the one making the purchase. By building features that solve problems for the child—like Jiobit for toddlers—they created more reasons for the parent to pay. Understanding this dynamic helped them design more relevant, high-converting offerings.

Offer solutions that grow with your user: Families evolve. A product that can serve a parent when their child is in grade school and still serve them when that child becomes a driver at sixteen becomes even more valuable.

🔥 Insider Growth Group’s Step-by-Step Guide to Identify and go after your ICP audience:

Going after a new Ideal Customer Profile (ICP) isn’t just about identifying a new user segment—it’s about a coordinated play across product, marketing, and sales.

Here's our detailed framework for identifying and winning over your next best customer.

Step 1: Analyze Your Current User Base

Segment users by engagement, retention, and conversion using analytics or an LLM.

Identify groups with strong feature usage, coming through direct / organic channels, or high NPS who aren’t converting. These might be high-intent users underserved by your current offering.

Step 2: Qualitative Deep-Dive

Talk to customers in these segments to understand their context, needs, and pain points.

Review sales and support conversations for patterns that might explain drop-off or high intent.

Step 3: Expand Onboarding and Attribute Data

Add targeted questions to onboarding flows to confirm hypotheses—like user role, intent, team size, or industry, and so on.

Combine this with product analytics and survey feedback to map retention and conversion rates to specific sub-segments.

Step 4: Validate With Metrics

Cross-reference onboarding data with downstream metrics—retention, activation, expansion.

Confirm if this segment converts at lower rates due to misalignment or untapped need.

Step 5: Build a Smart Account List

Use tools like LinkedIn Sales Navigator, Clay, Apollo, Keyplay, or ZoomInfo to identify accounts and contacts that fit your refined ICP.

Enrich with funding signals, tech stack, roles, or recent hiring activity to increase intent relevance.

Step 6: Create a New Offering and Observe Conversion Rate

Design bundles or solutions that solve this ICP’s immediate friction. Think small add-ons, new tiers, or usage-based pricing to see if you can improve conversion rates.

Take Life360: launch features like Jiobit for parents with younger kids.

Step 7: Launch Targeted Campaigns

Combine email, paid media, and LinkedIn outreach for coordinated exposure.

Use micro-campaigns targeting real-world events (like back-to-school, driver’s ed season) to add urgency.

Step 8: Build ICP-Focused Landing Pages

Create dedicated pages for your new ICP with tailored messaging, case studies, and social proof.

Use data to personalize based on company type, buyer role, or trigger (ex: visited pricing page).

Step 9: Invite to Engage and Self-Educate

Offer demos, free trials, or gated content that builds trust with your ICP.

Run intent-based retargeting using tools like Metadata or 6sense.

Step 10: Track, Learn, and Scale

Monitor behavior post-campaign: Are they converting? Retaining?

Document learnings in an internal ICP playbook that includes key pain points, feature preferences, and messaging wins.

Want help identifying or converting your next ICP or want to talk more about Pricing or Packaging?

Let’s talk.