Are you underpricing your product?

See how a company set their pricing and executed the change to increase revenue by 40%

A common challenge every Product and Business leader faces in their career is when and how to adjust pricing for their product line. This has become a hot topic in the last few years, as there is increased pressure to become profitable and continue to increase profitability.

There are generally five methods to justify new pricing increases, but we will be focusing this article on (a) how to know when you have an opportunity for a pricing change, (b) common pitfalls and mistakes that happen, and (c) how to do it the right way with confidence.

The five common methods to justify new pricing are:

1/ Value-Based Pricing: Charge based on how your user gets value. Mixpanel switched from charging for analytics events to charging for monthly tracked users. This aligned pricing with customer value.

2/ Add a New Use Case: Think Figma. Instead of changing an existing tier, they launched a new enterprise tier with its own pricing model.

3/ Billing Cadence: Switch from monthly to annual billing, or from transactional to subscription. Calm moved to annual-only subscriptions—locking in commitment and boosting LTV.

4/ Packaging Updates: Repackage what you offer. Dropbox increased storage from 1TB to 2TB and introduced Smart Sync. Same core product, better packaging, higher price.

5/ Price Increase: Amazon Music did it without changing a thing but showcasing new features they’ve launched to justify the price increase.

Addressing the fear of a pricing change head-on

Many business leaders are hesitant to adjust their pricing, fearing customer backlash or revenue loss. However, this reluctance often leads to leaving significant money on the table—sometimes as much as 40% of potential revenue.

And this fear is well justified. It can be a disaster for your company if you roll it out wrong.

Let’s take Toast, a prominent SaaS provider for the restaurant industry. In July 2023, Toast attempted to introduce a 99-cent fee for online orders that directly impacted its restaurant clients. This move led to severe backlash as restaurant owners, already operating on thin margins, saw this as a cash grab with no added benefit to their business.

It’s likely that Toast made common mistakes before rolling out this pricing change. They probably did not talk to customers or a customer advisory board to understand how customers will react. They likely did not test out pricing on a smaller customer segment to real-world test the pricing change. And they definitely did not clearly communicate the purpose of the fee - otherwise the restaurants would not have thought about it as a money grab.

There are many more. Zendesk, Unity, Comparato. Look at the headlines below - this is the nightmare that every CEO wants to avoid.

Now that’s enough about the blowups - we’re here to share tools and practices on how to do this right.

Companies that approach pricing with a structured and well-thought-out strategy find that they can make changes with confidence and reap the benefits.

Introducing Amit Saraf, SaaS pricing expert

Amit Saraf is a Senior Pricing Strategist at Pricing I/O, specializing in SaaS pricing, product management, and high-impact strategies. With extensive experience at Zynga, LiveRamp, and Calix, Amit has a proven record of driving product success from inception to multi-million-dollar revenue streams. At Pricing I/O, a firm that “takes the guesswork out of pricing”, Amit has worked with dozens of software clients that serve a range of industries, to significantly improve their monetization strategies.

Are you underpricing your product?

The first step to developing a pricing strategy is to understand if you are underpricing your product. Amit and Pricing I/O often find companies that are underpricing their services by significant margins. It is not uncommon for firms with $50 million to $200 million in revenue to find that they are leaving 40% or more on the table. Drilling down further with customer segmentation, disparities as high as 90% have been revealed.

In order to stay ahead of this, he uses the following frameworks, which are especially useful in B2B SaaS. Amit recommends companies in B2B SaaS re-evaluate pricing at least every 2 years and no more often than a 6 month period. A pricing committee that meets regularly and a formal or semi-formal process is the best approach here.

Willingness to Pay (WTP):

Understanding WTP is vital and can be assessed through customer interviews, surveys, CRM and product usage analysis, and competitor research. Popular methods like the Van Westendorp Price Sensitivity Meter and the Gabor-Granger technique provide structured ways to determine optimal pricing.

A key item that is often missed is there does not have to be one price across the board. By using customer segmentation, varying packaged offerings (entry vs premium), add-on modules, and strategically implemented gates, a company can capture different WTP levels across its customer base and better optimize for both revenue and value-delivered to its customer base.

Customer Advisory Board (CAB)

Having a customer advisory board can be very useful to start testing the waters with new pricing strategies. This is a group of customers that you can float ideas to and understand quickly, and without risk, if there are blind spots. Even without a formal CAB, a trusted group of customers can validate ideas and identify pitfalls quickly.

Segment your User Base

A common approach to aligning monetization more closely to value-delivered is by segmenting your customer base. Rather than use a single-variable approach, Amit recommends a 2-variable, 9-box approach with strategically chosen variables.

The most common segmentation is customer size or level that they pay, but that does not go deep enough. You can segment by variables such as:

Customer Tenure

Industry segment

Customer size

Product usage data

Level of discount to list

NPS rating

Even # of recent support tickets

Is it really all or nothing?

One of the largest misconceptions around pricing in the SaaS space is that a price change has to be an all or nothing game. Per research conducted by Pricing I/O, we know there is often a wide range of WTP (willingness to pay) for any given software product. Using that insight, it is likely that most software companies can improve alignment of value-delivered with willingness to pay, and it often be done in targeted and creative manners.

What happens if you encounter pushback? What do you do?

Let’s say there is a higher willingness to pay in your customer base (based on the Van Westerndorp methodology above), but you test this out in front of your CAB and get pushback on a potential price increase.

You should not give up there. You should dig further into the data and understand what segments may be more amenable to a price increase.

Is there a segment that was not represented within your CAB?

Or is there a higher tier offering you can introduce that will allow customers to choose to upgrade for premium features and/or support, and those that are more price sensitive can remain in a more restricted tier?

Or are there existing or future features you can offer as an add-on module to capture more value without increasing pricing on the overall base?

Pricing changes can, and often should, be offered in a targeted manner.

How to roll out a pricing change

Once you’ve determined you need a pricing change, it's critical to roll this out carefully and be well-coordinated as a team. There are multiple levers that one can leverage, and we discuss two of these below.

Option 1: Rollout with a standard Battlecard Strategy and Communication

A battlecard helps teams stay aligned on key talking points, pricing justification, and customer responses during price changes. Teams need to know what is ok to say and do not want unstructured conversations nor too many decisions made on the spot and based on a gut feel. GTM Teams are able to use battlecards as their “cheat sheet” for addressing push back on a price increase. Battlecards should be put together ahead of any pricing roll-out and are typically owned by the primary owner of pricing with input from customer success. This owner may be a product marketing lead, product management lead, or other GTM Lead.

Let’s go back to the Toast example. Imagine if they started with a sample group (ie a CAB or trusted set of customers). They would have understood quickly and w/o risk if there are blind spots. And the GTM teams would have been prepared when going into the communication to set the tone properly without sounding smug, apologetic, or non-responsive (all adjectives that Pricing I/O strongly recommends to avoid in any communication with customers).

Additionally, Toast may have supplemented its risk mitigation measures with preparation such as a battlecard strategy. In the below visual, you can see an example of that preparation. Each segment may have a battlecard, as outlined below, that highlights the key issues facing a customer that may be receiving a price increase. The battlecard gives the front-line employee an opportunity to quickly address any pushback. For instance, in the “Migration Play” section, we see how the front-line employee (example Customer Success representative) has an “if-then” scenario plan to address any push back. Having these battlecards and this plan, up front, greatly diminishes risk to the roll-out of a pricing change.

It’s critical to go in confident and direct with the reason for the change, but be willing to mitigate when needed.

Option 2: Run Strategic A/B Tests before rolling it out fully

Strategic A/B testing can offer valuable insights, though in B2B SaaS, it should be used judiciously. While data analysis is crucial, relying solely on numbers without considering broader market intuition can lead to misleading conclusions.

In B2B SaaS, A/B price testing should be used in a more limited and very strategic manner.

In B2C SaaS, A/B price testing should be used much more liberally.

The key here is to blend data analysis with some intuition.

A word of caution – Amit has seen companies go too deep into the data and miss the forest for the trees and some companies rely too much on “gut”.

Zynga was a classic case where everything in a game was A/B tested with deep data analysis. For instance, new promos were launched, and the PM would always show a nice uplift and the promo variant was chosen.

However, if you looked at the data across years, for the many promos that Zynga did, it was clear that revenue was just being brought up front versus a long-term change in monetization. This is driven, in part, by not being able to do year long or even months long hold out tests.

This is an example where getting too deep into the data drove misleading results.

It can be done well

A creative industry-specific software company, recently acquired by a private equity firm, suspected they were underpricing but needed concrete data to support this belief. While the PE firm strongly advocated for a price increase, internal opinions varied. Frontline sales and customer success teams voiced significant concerns. The management team was also mixed and concerned that a price increase would encounter adverse consequences.

Amit worked with the company to not only alleviate the team's fears, but demonstrate, with data and concrete insights, just how underpriced their products were.

Specifically, the team ran through its PDP (Pricing Design Program). This program included:

1/ Evaluating the opportunity

Analyzing the data. Win/Loss, Churn, and Reasons for Churn, product usage correlated to what was purchased and when it was purchased, etc.

Conducting customer and prospect interviews to understand how customers measure their ROI. Include recent “closed lost” in this list of interviewees.

Researching the competitive landscape - how were the new players, that were up and coming, and cheaper, being perceived?

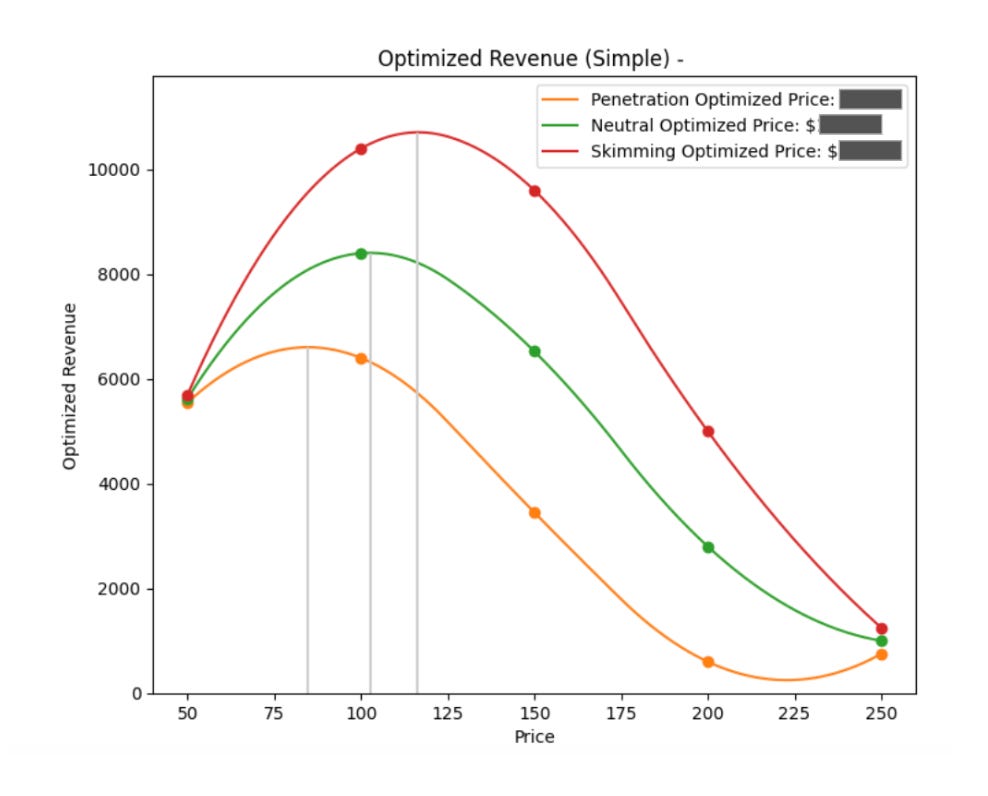

2/ Running WTP curves using proven WTP methodology (Gabor-Granger, Van Westerndorp)

The Gabor Granger, Van Westerndorp, or other method is a powerful tool that incorporates data-driven insights to set appropriate pricing levels. One approach to gathering this insight can look as follows:

Respondents are shown a description of the product/service.

Then they are asked how likely they are to purchase it at a given price point, usually on a 5-point scale from "Extremely likely" to "Not at all likely".

The price is then adjusted up or down based on their response, and the question is repeated.

This process continues until the highest price point the respondent is willing to pay is identified.

Through a WTP method similar to this approach, Amit’s team identified that rather than conducting a blanket price increase, it would be better to focus on a larger increase for a specific customer segment (approximately half the base) that showed the highest opportunity for upside.

Additionally, the data analysis and prospect interviews led the team to recommend an approach to aggressively reset the base for customers with legacy discounts. It was clear that new customers were signing up for the software services at prices much closer to the list price, legacy customers were using the product at similar rates to new customers, and that there was no clear reason that legacy customers remained at lower levels other than historical inertia and intelligent push back on prior attempts to raise pricing.

However, even with the recommendations in place, there were team members of the software business that were concerned around implementing a price increase. To bring these team members on board, multiple discussions were conducted talking the concerned team members through 1) why the data and insights supported the recommendation, 2) how to address any concerns specific to their specific role (commission and role-specific incentives can be a major hurdle to overcome), and 3) why a reset in pricing across legacy discounted customers would better set the company up for success in the future.

Finally, a robust and thorough risk mitigation plan, with battlecards and testing the roll-out, helped bring the CEO and even the private equity firm fully on board with the roll out.

By following this robust process, the software business was able to roll-out the price increase in an accelerated fashion and with more confidence — with an ARR increase of 40%!

Amit and team noted this is a common scenario, as anecdotal information from customers often masks what concrete data and insights portray.

Pricing Strategy Checklist

We went through a lot of content above. With any pricing strategy evaluation and rollout, remember that the below actions are fundamental to success.

Segment the User Base: Differentiate pricing based on customer needs and value perception.

Risk Evaluation: Analyze the potential impact and risks associated with each customer segment.

Voice of the Customer: Continuously monitor customer feedback and support interactions.

Segment Modeling: Design models for various customer types to understand potential outcomes of pricing changes.

Consulting Trusted Customers: Using a CAB or trusted client group to gather initial feedback.

Strategic Testing: Implementing changes on a smaller scale to detect blind spots.

Tailored Communication: Presenting changes confidently, with a clear explanation of how it benefits the customer.

Consistent Support: Preparing support teams to handle incoming queries with well-rehearsed responses.

Applying it to your business

We discussed a number of indicators that may suggest you have pricing power, and if so, a number of tools to monetize that opportunity. It’s likely you do have room to update your pricing, but at minimum you should regularly reevaluate it across your customer segments.

While any smart and driven CEO, CFO, product marketer, and/or product manager should be able to employ any of these strategies on their own, Amit has seen guided expertise in pricing deliver additional confidence and accelerate the ability for companies to monetize this opportunity, versus going it alone.

Amit’s firm, Pricing I/O, has the best people in the business for monetization in SaaS and have worked with 100s of clients on monetization opportunities. The firm includes pricing strategists, data-focused pricing analysts, as well as the founder, Marcos Rivera, who has an award winning book on SaaS monetization and is the founder of the firm. If you have any questions on the strategies above or are looking for more guided expertise, feel free to reach out here.

Are you enjoying these case studies?

Imagine having access to 100+ exclusive case studies to unlock even more growth opportunities and apply them directly to your job.

Join our course to learn the exact strategies that PMs from leading companies and what we’ve used to 2x our Monthly Revenue. Don't miss out on actionable insights that could drive real results for your business!

Pricing isn't just a number—it's a narrative about value, trust, and positioning. This piece brilliantly highlights the interplay between strategic insights and thoughtful execution. The Toast example is a stark reminder that pricing changes aren't about pushing numbers; they're about managing perception and relationships. It’s clear that the real challenge lies in balancing customer sentiment with data-driven decisions.

What’s one surprising insight you’ve uncovered from a successful (or not-so-successful) pricing change in your experience?