Personalizing GTM and pricing to fit your customers needs

Case studies from HubSpot, Bumble, and ZipRecruiter

Experiment 1: How HubSpot adjusted the funnel for larger firms to maximize revenue

Context:

HubSpot is a leading CRM and marketing platform, serving a diverse range of businesses from small startups to large enterprises. Their users vary widely in team size, industry, and needs, making it essential to adjust their sales strategies based on company size.

Problem:

HubSpot identified a conversion from free trial to paid gap between larger and smaller firms. There was a twofold challenge when it came to converting larger firms from free trial to paid plans.

First, larger companies were signing up for the free product expecting a more robust solution, but were often disappointed with the limitations of the free offering.

Second, many of these prospects were unaware that HubSpot offered trials for its higher-tier plans, which would have better suited their needs. This disconnect in expectations and product fit highlighted the need for a more tailored approach to the trial experience for larger organizations.

Sophia and her team at Hubspot tackled this problem.

Solution:

Before:

Previously, the typical user flow looked like:

Sign-Up for free product

Upgrade to starter or talk to sales: Users upgraded to HubSpot’s lowest tier paid plan, Starter.

Contact Sales if you were interested in converting at a higher tier plan

After:

The new flow for larger firms was:

Sign-Up – Same initial entry point for both firm sizes.

Contextual Upsells – As the users gained more value from the platform and engaged more there would be contextual upsells that would be introduced. These upsells were heavily focused on getting them to start the pro+ plan (advanced plan).

Self Serve Checkout OR qualified Leads for Sales – Once a user showed sufficient engagement during the trial period, they had an option to input their credit card and checkout through self-serve or talk to a sales team for a more hands-on approach.

Key changes included:

Contextual upsells and paywalls were integrated into the product encouraging larger users to explore higher tiered products through a trial.

For certain product lines Hubspot led with trials as the main purchase motion (vs the free product) based on certain aspects of the business they had come to Hubspot as an add-on product vs a core product.

Routing engaged users to the sales team for a personalized touch and deeper trust-building to help convert firms at a larger contract values.

Impact: Double digit Increase in Pro + conversions

Learning:

The Freemium first and trial later model can work well if you leverage trials in the right context where users would find the most value (i.e. features that are related to something they may already be using).

Not all user segments are the same—based on certain aspects of your users they may be coming to use you as an add-on product vs. using your software as a core product.

Experiment 2: How Bumble increased revenue in their non-core markets

Context: Bumble, a female-first dating app, had successfully grown revenue in their core markets—primarily the U.S, Canada and UK.

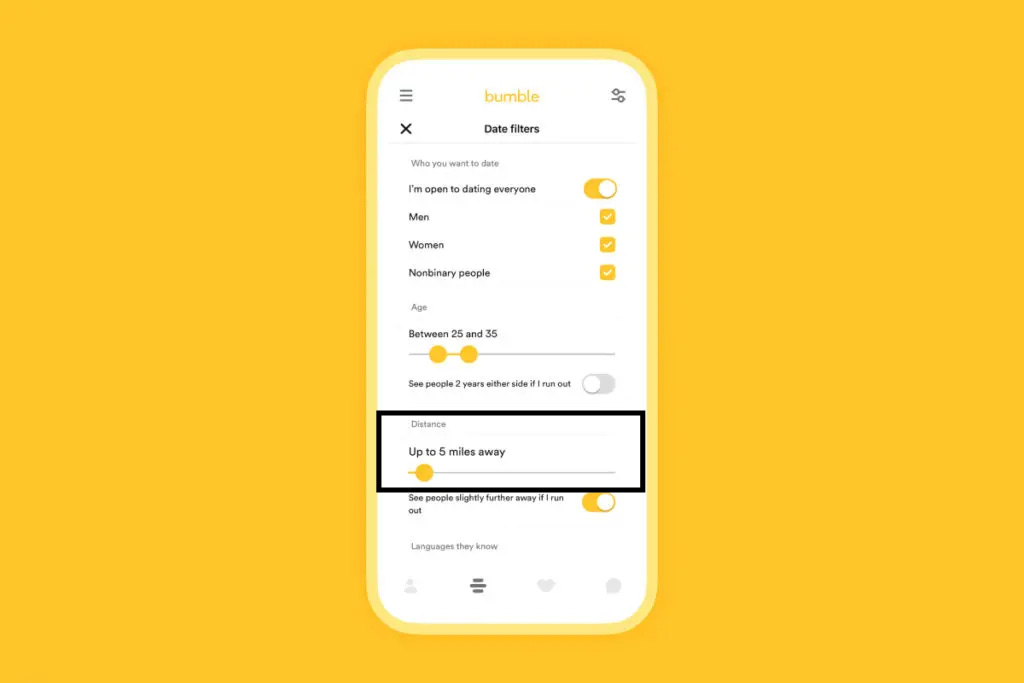

The platform allows users to set preferences such as height, distance, drinking habits, and religion to filter potential matches.

Problem: Bumble struggled to grow revenue in non-core, international markets due to a smaller pool of users. The app’s success relies heavily on network effects, and with fewer users to match, it became harder to maintain engagement and drive conversion to paid.

John Kneeland and his team tackled this problem.

Solution:

Before:

As part of Bumble’s strategy for growing outside of core markets, Bumble introduced "flexible" preferences. This feature would show users matches that didn’t exactly fit their preferences, such as people outside their desired distance or other set criteria. The idea was that it’s better to show users someone—even if they’re not a perfect match—than to show them no one at all. Bumble was betting that a higher volume of matches each day would create the illusion of a larger dating pool in smaller markets and help the platform reach critical mass in those markets.

*This was “flexible” in the BE matching algorithm.

After:

Bumbled learned their non-core markets weren’t growing fast and they kept having users write in saying the app was “broken.” Upon analyzing this data, Bumble discovered that distance was a key factor in international users rejecting matches and were unhappy.

Bumble pivoted to the hypothesis that it’s better to show users no one than to show them someone outside their desired distance, because they couldn’t possibly go on real dates with people on the other side of the country. They stopped being flexible on distance preferences and limited matches to users within the same city, even if this meant fewer matches per day, and higher churn for users upfront.

Impact: This change led to a 200% increase in international revenue and match rates. Although fewer people were shown, the users who did engage were more likely to convert into paying customers.

Learning:

Your core market playbook doesn’t always work in non-core markets. Strategies that drive success in your primary markets may not translate directly to international markets.

Do the right thing by your users, and they’ll reward you. It’s better to give them what they want vs. something that they don’t want for the sake of boosting metrics.

Early metrics can be misleading. Initially, retention dropped because users were seeing a smaller pool of potential matches. However, over time, the remaining users had higher intent and engagement, leading to stronger long-term revenue growth and conversions.

Experiment 3: Aligning Pricing with Value Delivery

Context:

ZipRecruiter, a leading online job marketplace, traditionally offered businesses a month-to-month subscription to purchase leads (job candidates).

Problem:

The monthly subscription fee could be a barrier for smaller businesses or those needing short-term hiring solutions. Although ZipRecruiter’s customers were receiving value daily in the form of new job candidates, the pricing model didn’t align with the frequency of value delivery. The company wanted to explore a pricing strategy that matched how often their customers were benefiting from the service.

Solution:

Before:

Offered only a month-to-month subscription model, requiring businesses to pay a larger fee upfront, regardless of how quickly they filled their roles.

After:

ZipRecruiter transitioned from a monthly subscription model to a daily subscription model. The idea was simple: hiring is often urgent, so why not align the billing cycle with that urgency. Instead of committing to a full month, businesses could now pay daily, only for the time they needed the service. This lower price point made it easier for businesses to commit, providing flexibility while encouraging faster decision-making on hiring.

The new approach:

Shortened the subscription duration to match the urgency of filling roles.

Lowered the upfront cost, making it easier for businesses to try the service.

Offered daily flexibility, letting customers pay only for what they need.

Impact:

The daily subscription model significantly lowered entry barriers, driving a 53% increase in conversion rates.

Although retention rates between daily and monthly subscribers evened out by month 5, the daily model generated higher overall revenue due to the cumulative cost and increased MRR by double digits.

Learning:

Most customers stick with the plan they start on. Once users subscribe to the daily plan, they rarely switch off, leading to consistently higher revenue over time.

Billing should reflect how often value is delivered. Matching pricing to the frequency of customer value creation can make the service feel more aligned with user needs.

Flexible pricing drives conversion. Offering options that reduce the financial commitment can lead to significant increases in conversion rates and revenue.