Building a world-class loyalty program is even easier with AI

How eBay cut churn from their most valuable customers by 50% using exclusivity and incentives as levers.

👋 Hi, it’s Gaurav and Kunal, and welcome to the Insider Growth Group newsletter, our bi-weekly deep dive into the hidden playbooks behind tech’s fastest-growing companies.

Our mission is simple: We help you create a roadmap that boosts your key metrics, whether you’re launching a product from scratch or scaling an existing one.

What We Stand For

Actionable Insights: Our content is a no-fluff, practical blueprint you can implement today, featuring real-world examples of what works—and what doesn’t.

Vetted Expertise: We rely on insights from seasoned professionals who truly understand what it takes to scale a business.

Community Learning: Join our network of builders, sharers, and doers to exchange experiences, compare growth tactics, and level up together.

Most loyalty programs are lies. They are disguised discount schemes designed to get the average user to buy one more item they didn’t need.

But for leaders in high trust, high ticket industries, a points system isn’t just ineffective; it’s a distraction from your unit economic reality.

In these sectors, you aren’t playing a volume game. You are playing a “whale” game, where a small percentage of power users drive the vast majority of your revenue and often dictate your product roadmap.

Unlike the average consumer, these whales don’t trade engagement for badges. They trade capital for certainty. And that certainty looks different and expensive across every vertical:

In B2B SaaS: You aren’t optimizing for DAU, you are optimizing for annual contract value. A single Enterprise client creates more revenue than 1,000 SMBs. But they demand SOC2 compliance, 99.99% SLAs, and dedicated account managers.

In Fintech: Your revenue is concentrated in high-volume traders or high-net-worth individuals. They don’t care about streaks, they care that their assets are liquid and secure. That requires expensive KYC (Know Your Customer), fraud detection, and insurance.

In Real Estate & Luxury: The buyer isn’t looking for a “fun” transaction, they are terrified of a counterfeit one. The cost here is physical authentication, white-glove logistics, and escrow services.

Providing this certainty costs money. It requires high-touch operations just to get a seat at the table.

This is the Trust Tax.

And this is all fine as long as your product’s whales have the high LTV you expect them to.

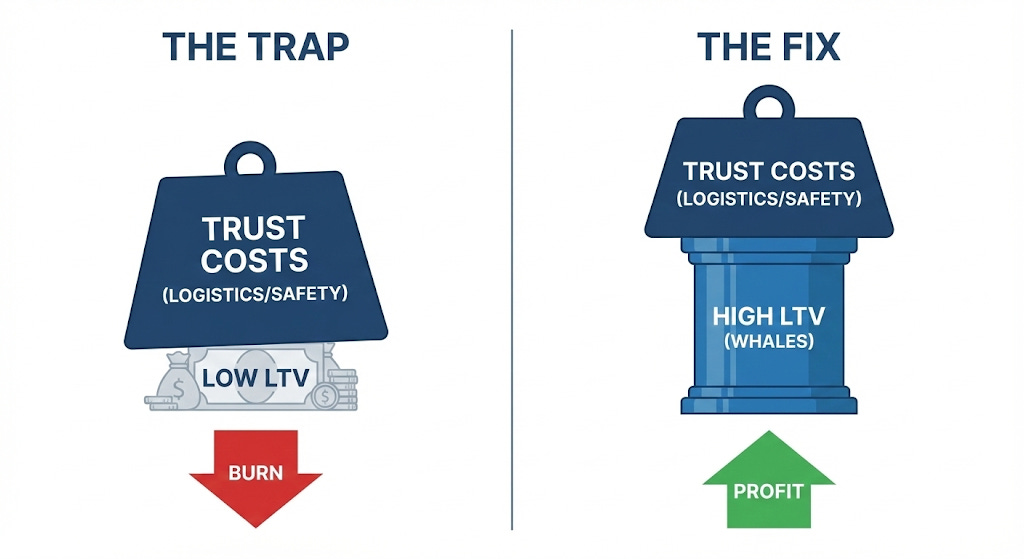

But here’s the trap: If you pay this tax but still suffer high churn, your business model breaks. You are burning cash on high-cost operations without the lifetime value (LTV) to back it up.

The highly competitive resale market of sneakers and watches

To understand the leak, you have to understand the player. The “whales” in this market aren’t just kids looking for a quick flip. They are sophisticated arbitrageurs and mega-collectors building portfolios that rival the value of a physical home. They treat sneakers as a serious asset class.

But for years, eBay forced these high-value users to operate in a “Wild West” environment. The platform offered massive inventory but zero trust-building tools. Every transaction was a gamble: Is the seller legit? Is the stitching real? Will I get a brick in the box?

This trust deficit was the existential threat. To fight the flood of counterfeits and win back credibility in their luxury verticals (sneakers, watches), eBay launched Authentication Guarantee.

The investment was massive: they built physical centers to verify every high-value item. And while it worked for securing general trust, such as bringing casual buyers back to the platform, the unit economics for their most important users were breaking.

The leak wasn’t the casual buyer. It was the whales, the top 1% of users spending ~$10k/year. Despite the new safety features, this cohort was churning at 45% YoY.

The mistake wasn’t assuming that whales wanted safety—they absolutely did. No one wants to spend $2,000 on fake Jordans. The mistake was assuming safety was enough.

For a casual buyer, safety is the product. But for a whale, safety is just a baseline requirement. The real product is the deal.

Beyond just the table stakes of authentication and safety, eBay was just another platform for them to price compare and hunt for their next pair in their collection in a very hot sneaker resale market. These users were driving the platform’s liquidity, yet they were treated exactly like a first-time guest. They needed a signal that their volume mattered. They craved an exclusive experience that rewarded their loyalty with access that the general public didn’t have.

The Insider: Ankit Agarwal

We collaborated with Ankit Agarwal, a Product Leader previously at eBay that led the strategy and growth for sneakers and watches. In this deep dive, we’ll showcase how this challenge was promptly addressed by creating the eBay Top Star program to generate the exclusivity the users craved.

The Case Study: Flipping the Negative Mindset

To understand the solution, you have to understand the psychology of the user. Ankit realized that retention isn’t about features. It is about emotional state management.

The Problem: The Consolation Prize Trap

eBay had an inventory problem, but more importantly, they had an emotional problem. Buyers arrived at eBay in a negative mindset.

In the sneaker world, inventory isn’t stocked. It is “dropped.”

A “drop” is a scheduled release of a limited-quantity product where demand outstrips supply by 100x. Because you can’t just buy the item, the primary market (apps like Nike SNKRS or Adidas Confirmed) operates on a lottery system. You enter a draw for the chance to pay $200.

99% of the time, you lose.

The Loss: Users take a loss on the primary drop.

The Resignation: Frustrated, they come to eBay as a last resort.

The Cost: They are forced to pay 2x-3x retail price on the secondary market.

The Feeling: They felt the platform was purely predatory. They believed eBay didn’t share their passion and just wanted their fees.

A frustrated customer combined with a high-friction experience creates the high churn.

The Solution: eBay Top Star

Ankit and his team realized they couldn’t just offer points. Points are for casual users. Experts want access.

They launched eBay Top Star, an invite-only program designed to change the user’s emotional state from exploited to insider.

1. Flipping the Economics (Loss → Win)

They identified the user’s moment of highest frustration, losing a drop on a primary app, and turned it into a moment of delight.

The Tactic: eBay secured inventory of highly coveted drops (Jordans, Yeezys) and sold them to Top Star members at MSRP (Retail Price) instead of the resale price.

The Math: eBay took a margin hit on these specific items because the CAC of re-acquiring a churned whale is higher than the subsidy on a pair of sneakers. They turned the last resort into the first victory and instantly gave the user hundreds of dollars in equity.

2. The Concierge Hunt

They provided direct access to human agents who acted less like support and more like brokers.

The Tactic: If a Whale wanted a specific pair of 1985 Chicago Jordans that wasn’t listed, the agent wouldn’t say “Sorry, out of stock.” They would go hunt for it by leveraging eBay’s massive data to find a seller or looking off-platform to facilitate the deal.

The Effect: This proved to the user that eBay wasn’t a utility. It was a partner in their collection strategy.

3. Experiential Exclusivity

They moved beyond digital transactions to physical validation.

Gifting: Instead of generic swag, they sent hyper-personalized accessories. Each member got a personalized welcome kit with an exclusively created collectors item, special shoe care accessories as a surprise in your regular order.

Events: They demonstrated that the sneaker passion was truly shared! They gave away tickets to SneakerCons all over the country. They hosted “Top Star” parties with performers like Zak Bia at industry events like ComplexCon. Only members and industry pros were invited. This created a visible status hierarchy where being in the room meant you were in the inner circle.

4. Strategic Ambiguity

Perhaps the smartest psychological lever was keeping the criteria opaque.

The Halo Effect: There was no progress bar saying “Spend $500 more to reach Gold.” This created buzz in the sneaker community. Users actually started transacting more just to prove their worthiness to the algorithm. Uncertainty drove engagement.

The Impact

The results of treating the top 1% like actual VIPs were immediate.

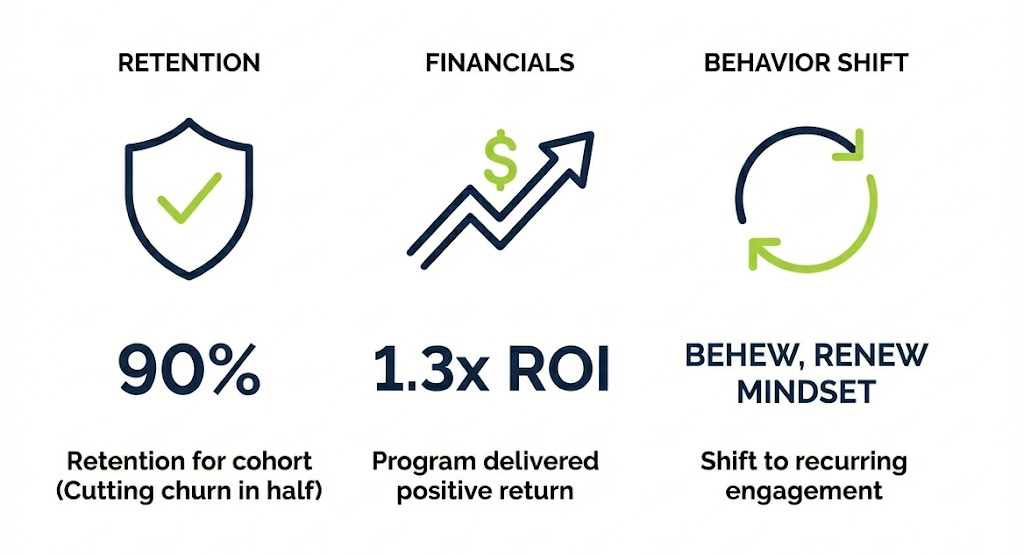

Retention: Retention for the cohort hit 90% (cutting churn in half).

Financials: The program delivered a 1.3x ROI.

Behavior: It shifted users from “one-off” buyers to a “renew, renew” mindset.

The Lesson

Address a key pain for your users completely. Identify the exact moment your customer feels defeated by the market and design your offering to solve that specific pain.

If you’ve gotten this far, you may be ready to navigate to the 🔥 section and check out our Playbook now.

The AI Pivot: Building the White Glove Machine

Ankit’s program worked, but it was operationally heavy. It required headcount, manual sourcing, and high-touch management.

The Good News: Today, you can replicate the Top Star program using a stack of AI Agents without the bloat. You can scale white glove service to 10,000 users without hiring 100 account managers.

1. Universal Application: How to “Top Star” Your Industry

The eBay Top Star example isn’t just for sneakers. It is a universal loyalty loop for any high-ticket business. Here is how you can apply this concierge strategy to other verticals:

B2B SaaS

In enterprise software, your VIP clients don’t want swag; they want their feature requests prioritized. Instead of a generic “we’ll look into it,” imagine a system that automatically scans your internal product roadmap, identifies the exact Product Manager who owns that feature, and drafts a pitch to fast-track it. You aren’t just supporting the client; you are lobbying for them.

Fintech

In banking, the most valuable moment is a “liquidity event.” Imagine a system that instantly detects when a user hits a high cash balance and proactively reaches out—not with a generic newsletter, but with a direct invite to exclusive high-yield funds usually reserved for institutional investors. You turn a deposit into a status symbol.

Real Estate (The Off-Market Hunt)

In luxury real estate, the best deals never hit Zillow. Imagine a system that monitors private dealer networks and off-market forums 24/7. When a VIP buyer says, “I want a Mid-century modern in Silver Lake,” the system notifies them the second a rumor hits the network, giving them the first-mover advantage before the public ever sees the listing.

2. The Modern Blueprint: Rebuilding Top Star Today

If we were to rebuild eBay TopStar today, we wouldn’t hire an army of concierge agents. We would deploy a coordinated AI system to deliver the same high-touch experience at scale.

Here is the detailed end-to-end flow of that modern architecture, using a luxury watch buyer (The “Whale”) as our case study. Note how the system feels human and bespoke, despite being fully automated.

The Trigger: The User texts the dedicated VIP number: “I’m looking for a Rolex Submariner, birth year 1992.”

The Acknowledgment: The AI replies instantly, adopting the persona of a knowledgeable broker: “Great choice. 1992 is a tough year for Subs, but let me put the team on it. Give me 24 hours.”

The Hunt: In the background, the system activates. It scrapes 4 major marketplaces and 2 private dealer networks. It filters out damaged inventory and finds two perfect matches—one in Tokyo, one in NYC.

The Pitch: The AI texts the user with a curated selection: “Found two. One in Tokyo (Mint, Box & Papers) for $14k. One in NYC (Watch only) for $11k. The Tokyo one looks cleaner. Want photos?”

The Close: User says “Tokyo.” The AI generates a secure payment link and handles the checkout.

The Assurance: Three days later, the system detects a customs hold via the shipping API. It proactively texts the user to manage anxiety: “Quick update—watch is clearing customs in LA. Might be 1 day late, but it’s moving.”

The Result: The user feels like they have a dedicated personal shopper, but in the background this is all being coordinated by AI agents.

3. The Stack & The 4-Agent Architecture

To build this, we don’t use a simple chatbot. We use a Multi-Agent System (MAS) where agents have distinct roles and hand off tasks like a relay team.

The Tech Stack:

Orchestration (The Brain): Relay.app (No-code) or LangGraph (Code). This acts as the traffic controller.

Intelligence: OpenAI GPT-4o (for nuance and tone).

Execution: Custom Python Scripts (for scraping and API calls).

The 4-Agent Architecture

1. Agent 1: The Gatekeeper (The Qualifier)

The Job: Most programs fail because they only look at total spend. This agent scores users on Passion Metrics—search velocity, specific niche keywords, and dwell time.

The Output: It acts as the bouncer. It tags the user in your CRM as Status: Top_Star_Eligible and triggers the Hype Man to send the invite.

2. Agent 2: The Hunter (Buyer Agent)

The Job: The Concierge inventory hunt. Once it receives an order, it scans global listings across the web (StockX, GOAT, eBay, Private Forums) to find the item.

The Output: It finds 3 options, formats the pricing and condition, and passes the data to the Hype Man.

3. Agent 3: The Hype Man (The Relationship Manager)

The Job: This is the only agent that speaks to the customer. It handles all inbound requests and outbound hooks.

Intent Detection: When a user texts “I need 85 Chicagos,” it uses NLP to extract the Intent (Buy), Item (Jordan 1 Chicago), and Condition (1985 Vintage).

The Output: It polishes raw data from the Hunter into a conversational, high-status text message.

4. Agent 4: The Safety Net (Support)

The Job: Proactively monitors shipping and authentication APIs. It wakes up only when a transaction is in flight.

The Output: If it detects a delay at the authentication center, it drafts a message for the Hype Man to reset expectations before the user gets anxious.

The Human Moat (Where AI Fails)

While agents can handle the logistics, Ankit notes there is a limit. You cannot automate the Trust Tax entirely. There are three areas where you must keep humans in the loop:

Authentication (Sensory Verification): AI cannot verify the smell of vintage leather or the material feel of a $50k item. You still need human experts for the final stamp of approval.

The Gray Area Exception: AI follows rules strictly. Humans break them to save relationships. Sometimes you need a human to authorize a refund outside of policy to save a client with $100k LTV.

Physical Community: An agent can’t buy you a drink at Sneaker-con. The physical handshake remains the ultimate retention tool.

🔥The IGG Playbook: How to Build the White Glove Machine

Most founders think they need more features to retain high-end customers. You don’t. You need a different operating model.

If you are running a high-ticket or high-trust business, here is your step-by-step roadmap to reducing churn with a white glove machine.

Step 1: Audit Your Trust Tax (The P&L Check)

You need to mathematically define if you have a retention problem.

The Calculation: Calculate your Cost to Serve (CTS) for your top 1% of customers. Include “hidden” costs: manual onboarding hours, insurance premiums, verification fees, and dedicated support slack channels.

The Trap: If your CTS is high, you cannot afford “standard” churn at 5-10%. You are paying a premium to acquire and serve these users.

The Rule: If your Trust Tax exceeds 20% of the contract value, you must treat Retention as a product, not just a metric. You need to build your own Top Star program to defend that margin.

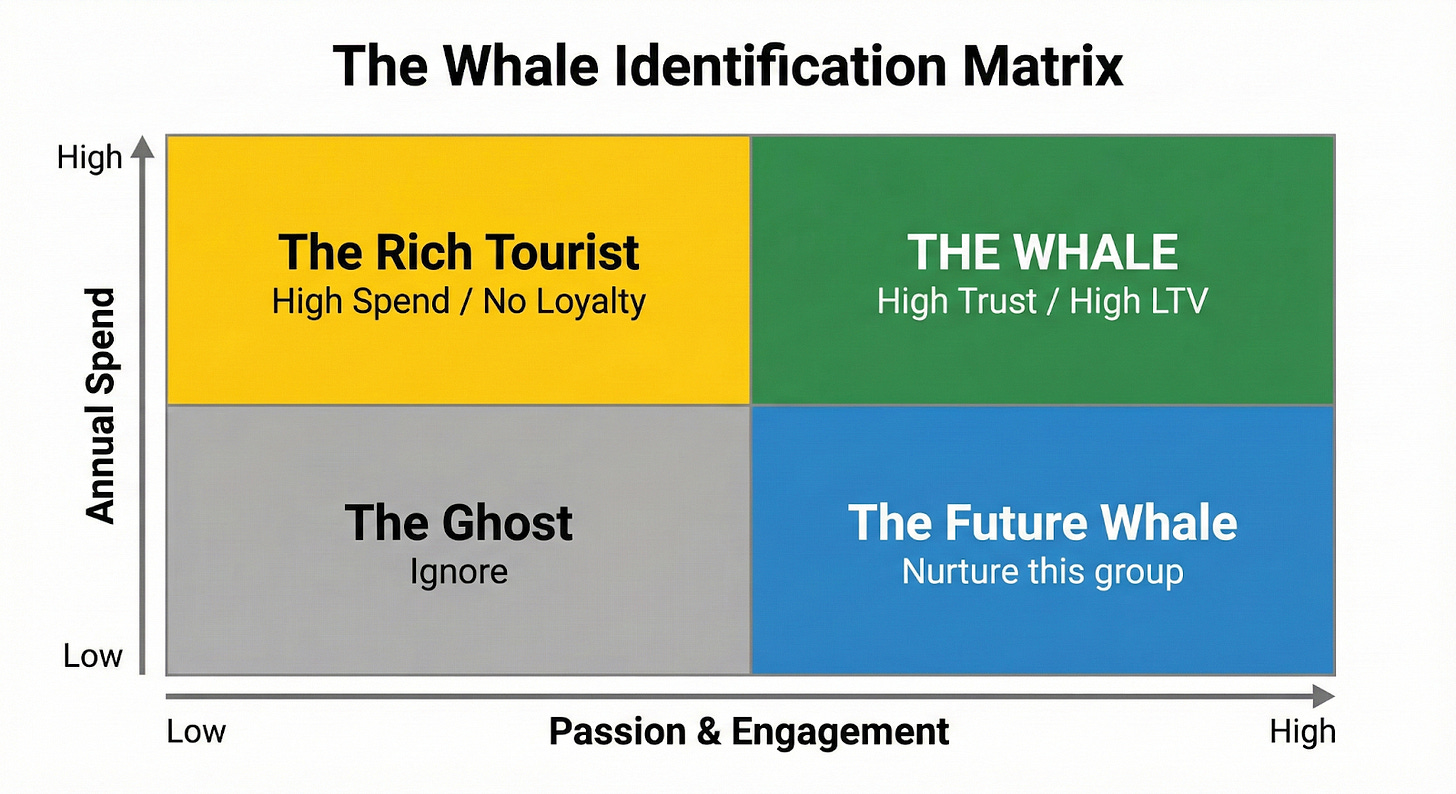

Step 2: Identify the “Whale” (The Matrix)

Most companies get this wrong. They define a VIP solely by Current Spend. This is a mistake.

High Spend + Low Passion = “The Rich Tourist.” They have money but no loyalty. They will leave you for a competitor who is 5% cheaper. Do not over-invest here.

High Spend + High Passion = “The Whale.” They spend and they engage (search history, support tickets, community presence). These are the only users who belong in your Inner Circle.

Remember that passion can be defined by metrics like search velocity, specific niche keywords, and dwell time.

Use this matrix to segment your user base today:

Step 3: Solve the “Impossible” Pain

Your value prop cannot just be better service. It must be an unlock—solving a problem the customer has accepted as impossible to solve in the market.

B2C Example (eBay):

The Impossible Pain: “I will never win a Nike SNKRS lottery.”

The Unlock: “We secured the inventory. You win here.”

B2B Example (Enterprise SaaS):

The Impossible Pain: “Migrating my data from Salesforce will take 6 months and break my reporting.”

The Unlock: “Our AI Migration Agent + Human Architect team will do it for you in 48 hours, guaranteed.”

Action: Find the one friction point your industry considers standard operating procedure and eliminate it for your Inner Circle.

Step 4: The Augmented Concierge Model

You cannot scale white-glove service with humans alone. You must use the 80/20 Augmented Concierge Model.

80% AI (The Legwork): Use the Agent Stack (Gatekeeper, Hunter, Hype Man) to handle the “drudgery”—sourcing inventory, qualifying leads, and monitoring shipping.

20% Human (The Glory): The human never does data entry. The human only enters the loop for the “Glory Moment”—the final confirmation call, the exception approval, or the physical handshake.

The Golden Rule: The AI prepares the gift. The Human hands it over.

Did this post make you think about how you can replicate exclusivity or incentives to your own product or company? It’s even faster now using AI. If so, let’s talk!